Health insurance is an essential aspect of financial planning and personal well-being. Whether you’re self-employed, working for a company, or managing a family, understanding how health insurance plans work can save you time, money, and stress in the long run. With many options available and a range of terms to know, choosing the right plan may seem overwhelming at first—but it doesn’t have to be.

This guide will walk you through the basics of health insurance plans, the different types available, and what factors you should consider when selecting a policy that suits your needs.

What Is Health Insurance?

Health insurance is a contract between you and an insurance company that helps cover medical expenses in exchange for monthly premiums. It can help pay for hospital visits, doctor appointments, prescription medications, and preventive care. The goal of health insurance is to reduce the financial burden of healthcare services.

Why Health Insurance Matters

Financial Protection

Without insurance, a single medical emergency can cost thousands of dollars. Insurance cushions you from unexpected expenses, providing a safety net.

Access to Quality Care

Many insurance providers have networks of doctors and hospitals. Being insured gives you access to better care at lower negotiated rates.

Preventive Services

Most plans include preventive care—such as checkups, screenings, and vaccinations—at no additional cost, helping catch problems early.

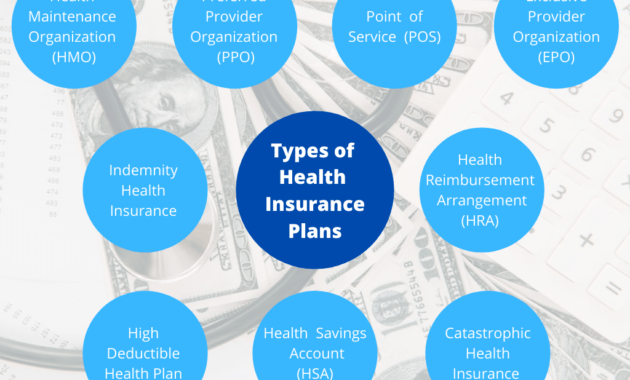

Types of Health Insurance Plans

Understanding the main types of health insurance can help you compare options more effectively.

Employer-Sponsored Health Insurance

Many companies offer group health insurance as part of employee benefits. These plans are typically more affordable and offer better coverage because the employer pays a portion of the premium.

Individual and Family Health Insurance Plans

If you’re self-employed or your employer doesn’t offer insurance, you can purchase an individual or family plan through the health insurance marketplace or directly from providers.

Government-Sponsored Health Insurance

These programs are designed for specific groups and often funded or subsidized by the government.

- Medicare: For people aged 65 or older and some with disabilities

- Medicaid: For low-income individuals and families

- Children’s Health Insurance Program (CHIP): For children in families with income too high for Medicaid but too low to afford private insurance

Short-Term Health Insurance

Designed for temporary coverage gaps, such as when transitioning between jobs. These plans offer limited benefits and do not typically cover pre-existing conditions.

Catastrophic Health Insurance

Low-premium plans with high deductibles designed for young, healthy individuals. They offer essential benefits and protect against worst-case scenarios.

Key Components of a Health Insurance Plan

Premium

The amount you pay monthly to maintain your insurance coverage.

Deductible

The amount you must pay out-of-pocket before your insurance starts to cover costs.

Copayment (Copay)

A fixed amount you pay for a specific service, such as $30 for a doctor’s visit.

Coinsurance

The percentage of costs you share with the insurer after you meet your deductible (e.g., 80/20 means you pay 20%).

Out-of-Pocket Maximum

The maximum amount you will pay in a year. Once reached, the insurance covers 100% of remaining costs.

Network

A group of healthcare providers and facilities that have agreed to provide services at reduced rates.

Comparing Health Insurance Plans

When choosing a plan, compare these features carefully to find one that best fits your needs.

Coverage Options

Check what services and treatments are covered—like mental health, maternity care, prescriptions, and emergency services.

Provider Network

Make sure your preferred doctors and hospitals are in-network to avoid high out-of-network fees.

Total Cost

Don’t focus only on the monthly premium. Consider the deductible, copays, coinsurance, and out-of-pocket maximum.

Prescription Coverage

If you take regular medication, review the plan’s formulary to see what’s covered and at what cost.

Flexibility

Some plans require referrals for specialists, while others let you see any provider within the network.

Common Types of Health Insurance Plans

Health Maintenance Organization (HMO)

- Requires members to choose a primary care physician (PCP)

- Referrals needed for specialists

- Lower premiums and out-of-pocket costs

- Must use in-network providers

Preferred Provider Organization (PPO)

- No referrals needed to see specialists

- Can use out-of-network providers at a higher cost

- Higher premiums than HMO but more flexibility

Exclusive Provider Organization (EPO)

- Must use in-network providers (except in emergencies)

- No referrals needed

- Lower premiums than PPOs

Point of Service (POS)

- Hybrid between HMO and PPO

- Requires a PCP and referrals

- Allows out-of-network care with higher costs

High Deductible Health Plan (HDHP)

- High deductibles with lower monthly premiums

- Can be paired with a Health Savings Account (HSA)

- Suitable for people with minimal health needs

How to Choose the Right Plan for You

Evaluate Your Health Needs

If you frequently visit doctors, a plan with higher premiums and lower deductibles may save you money. If you’re generally healthy, a high-deductible plan may be more cost-effective.

Consider Your Budget

Balance what you can afford in monthly premiums with what you’d be comfortable paying out-of-pocket in an emergency.

Check Available Networks

Choose plans that include your preferred hospitals and physicians. Using in-network services saves money.

Review Plan Ratings

Government websites and third-party organizations provide customer satisfaction and quality ratings that can help guide your decision.

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

These accounts let you set aside pre-tax money for medical expenses.

- HSA: Available with high-deductible plans; funds roll over year to year

- FSA: Typically offered by employers; may have a “use it or lose it” policy

Common Health Insurance Terms You Should Know

- In-Network: Providers who have agreed to discounted rates

- Out-of-Network: Providers not part of the plan; more expensive

- Formulary: A list of covered medications

- Preauthorization: Approval required before receiving certain services

- Lifetime Limit: The maximum the insurer will pay over a lifetime (now banned in many cases under the ACA)

How Health Insurance Affects Your Taxes

- Premiums for employer-sponsored insurance are usually pre-tax

- Contributions to HSAs are tax-deductible

- You may qualify for premium tax credits if purchasing from a marketplace

Mistakes to Avoid When Choosing Health Insurance

- Ignoring the total cost of care

- Overlooking your medication coverage

- Not checking the provider network

- Skipping preventive care due to cost concerns

- Choosing a plan solely based on the lowest premium

Also Read : The Future Of Insurance: Trends And Innovations

Conclusion

Health insurance plays a critical role in protecting your finances and ensuring access to quality care. By understanding the different types of health insurance plans, how they work, and what to consider when choosing a plan, you can make informed decisions that support your physical and financial well-being.

Whether you’re buying insurance for the first time or reviewing your current plan, take the time to evaluate your health needs, compare options, and understand the fine print. The right health insurance plan can provide peace of mind and help you stay healthier in the long run.

FAQs

What is the difference between HMO and PPO plans?

HMO plans require referrals and restrict you to in-network providers, while PPO plans offer more flexibility and let you see specialists without referrals.

Can I change my health insurance plan anytime?

Typically, you can only make changes during the Open Enrollment Period unless you qualify for a Special Enrollment Period due to life events like marriage or job loss.

What happens if I go to an out-of-network provider?

You may have to pay higher costs, or your services may not be covered at all, depending on your plan type.

Are all preventive services covered?

Most ACA-compliant plans cover preventive services like vaccines and screenings at no cost to you.

How can I reduce my health insurance premiums?

You can opt for a higher deductible, shop around during open enrollment, or qualify for subsidies or Medicaid depending on your income.